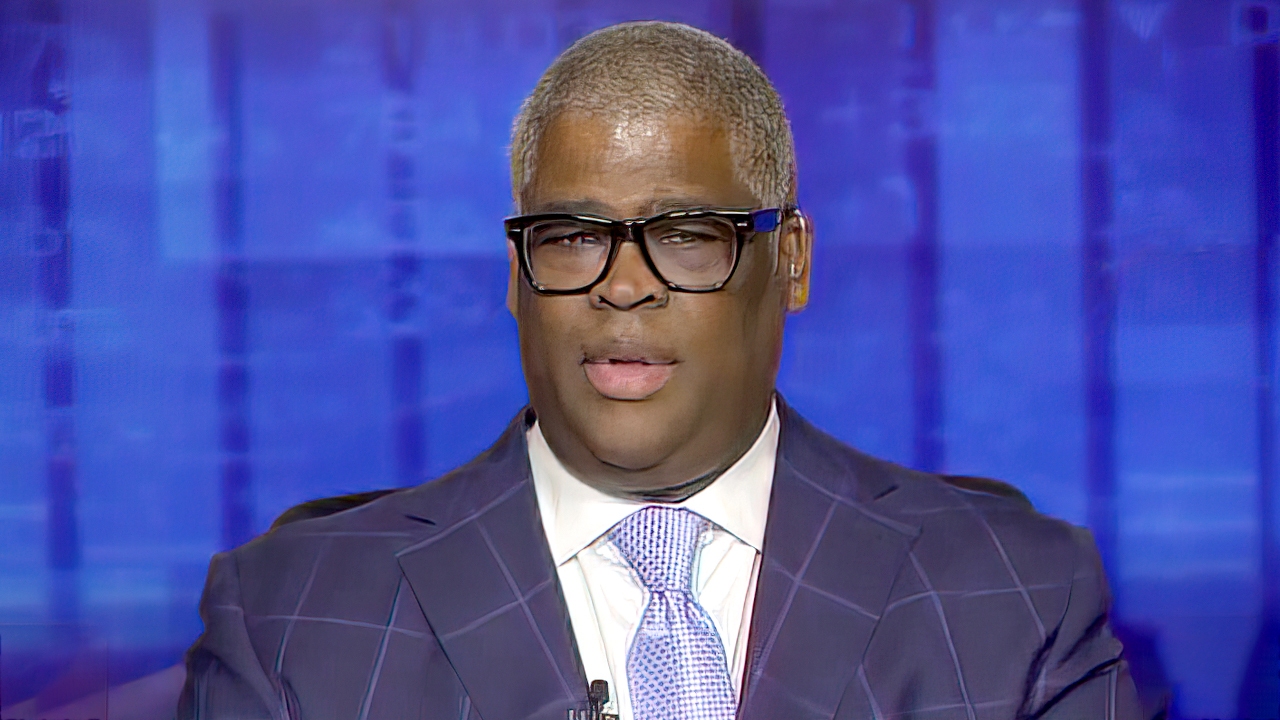

CHARLES PAYNE: What every American needs to do when the stock market is sinking

Investing in the market is a lifelong endeavor -- the sooner you start, the better off you will be.

Looking at the last hundred years, it seems like an easy decision. Since the late 1970s, anyone would take all the gains in the S&P 500 against the occasional loss. Investors aged 18 to 81 are fortunate to live in this era.

Investors today are already carving out:

A different approach

A different confidence

Instead of reacting emotionally and indefinitely postponing investment plans due to market volatility, the fresh bear market provides the perfect timing to get in.

I am imploring everyone to be ready to confront a situation head-on and to be opportunistic.

This is more than buying the dip. Long-term investors should be building positions right now and everyone should be a long-term investor.

It is advisable to trade with a portion of your portfolio while maintaining core positions that could significantly impact your financial situation. Great news! Positions are available, both new and familiar, at discounted prices.

I aim for you to thrive in periodic corrections and bear markets, not merely survive them.

An old saying suggests success comes from time invested in the market rather than timing the market. This is true, especially if you are a passive investor. But there is a much bigger return for those genuinely prepared to seize the moment.

U.S. household wealth in the stock market now makes up 170% of disposable income. The top 10% of American households own 87% of all stocks. Ironically, the top 10% percent is hoping the current turmoil will make you give up and sell your portfolio now. In the future, the experts will run the money while you vote in the interest of corporations over Main Street.

Regular folks have realized that the stock market is how you can get rich. The American way of life revolves around the financialization of the economy and the stock market. We stopped investing in factors and in people, and instead, money makes money.

There have been 35 recessions in the United States since 1854. During this time, we fueled a boom that lifted the country past the U.K. The Second Industrial Revolution created major cities and disposable income and triggered the American Century.

Looking at recent years, what stands out?

CLICK HERE TO READ MORE ON FOX BUSINESS

Fewer and shorter recessions. The system is designed to bounce back quickly. And along with the rebound in the economy comes the rebound in the stock market.

The fix is in.

So, when the stock market is tumbling, and Wall Street and the financial media go into overdrive, urging people to sell, you must consider two other alternatives.

I know you are smart enough, but there is a difference between knowledge and smarts; the key is tangible experience.

I always crack up at memes of old folks having a blast doing all kinds of crazy things without a care in the world because they bought their $5 million house for 12 raspberries in 1947.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Baby boomers are still buying more homes than millennials and Gen Z has completely given up.

I get the bitter sarcasm because today's young adults believe they will never have the chance to buy the American Dream. I understand that, and I share your frustration.

If possible, I am sure you would like to travel to the past and buy a house. H.G. Wells published "The Time Machine" in 1895, a profound book with a deep message. Several films have been adapted from the book, notably the 1960s version starring Rod Taylor. What I like about the story is the ability to go back in time and into the future.

What if you could do that in real life and join the boomers, scooping up all those houses for fruit? You can use a time machine to build wealth in the stock market.

When you look at a long-term market chart, the pullbacks look frightening. But from now on, you should treat them like going back in time and buying great stocks at prices that will profoundly change your life.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.jpg?#)

.png?Expires=1838763821&Key-Pair-Id=K2ZIVPTIP2VGHC&Signature=IO0~CT3pU-TcxGc~yoZSmoQx23MZVuK-~4jSii~NKEblRmyO3el7NXPu~Rh1o23voASg7hlcHLw4kvQuDK1jssEhcjoNBBvEpZ~GGOAU6yosBhpHpeF179F~h7i6VxmsBNh9gtTutkoqY73O2YCFey~IAqSzKbBqETP1kP9cAg1916Z1YkJJs-5MliMrkZ5d7-mWGLbpHp2wGj2VlMph8XzYlL4~y1O7fB~JdIS~Rs4RMRs2x0WT1qUIpHAsf3GdwtOyAmKFSpIg8xCyNGZZ5h~13nXlmpd7uPvW8tBfttpG9pFTqcway-uch5WyfHOEfi7UlJCOWrr6fCYY5PMgSg__)