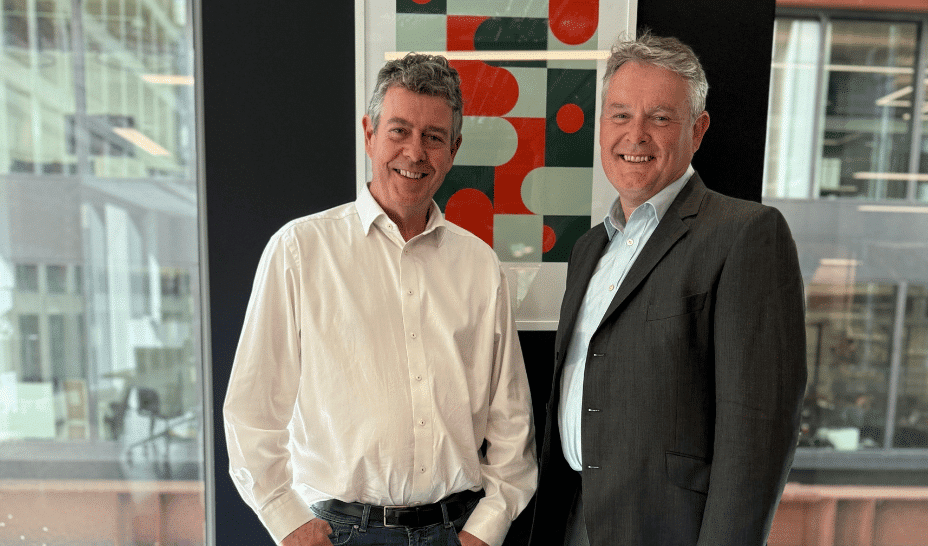

Northern Gritstone and Parkwalk team up for new EIS fund – will it deliver the UK’s first trillion-euro startup?

Manchester-based investment company Northern Gritstone has partnered with London-based Parkwalk Advisors to launch the Northern Universities Venture Fund, an Enterprise Investment Scheme (EIS) fund designed to offer investors early-stage access to science and DeepTech spinouts from the Universities of Leeds, Liverpool, Manchester, and Sheffield.

This new initiative aims to channel investment into commercialising IP-rich innovation from the North of England, targeting breakthrough sectors such as quantum computing, artificial intelligence, engineering biology, semiconductors, HealthTech, and CleanTech. The fund will be managed by Parkwalk Advisors, an active university spinout investor with over €584 million in AUM.

Duncan Johnson, CEO of Northern Gritstone, said: “I am convinced that the UK’s first trillion-dollar business will emerge from investing into UK university science and technology. The launch of Parkwalk’s Northern Universities Venture Fund is a way to bring untapped innovation from the North of England to a broader investor base.”

Northern Gritstone, active since 2022, supports startups emerging from academic institutions, aiming to combine returns with societal and regional impact. To date, it has invested in 37 companies, backing innovations in semiconductor design, novel materials, AI, secure computing, healthtech, and gene therapies.

Earlier this year, it raised an additional €58.4 million from institutional investors including Aviva and Fulcrum Asset Management, bringing its total committed capital to €423 million.

Founded to advance ‘profit with purpose’, Northern Gritstone’s mission is to foster job creation and regional development while delivering strong investor returns. Alongside its investment activities, it operates NG Innovation Services, which offers early-stage businesses access to capital and expertise through its ‘Capital+++’ platform.

Moray Wright, CEO of Parkwalk Advisors, said: “This collaboration brings together two of the UK’s leading forces in university commercialisation. Parkwalk’s expertise in venture capital and DeepTech, combined with Northern Gritstone’s unrivalled university partnerships, means we can offer investors access to an exceptional and underexploited pipeline of innovation.”

Parkwalk Advisors, a subsidiary of IP Group plc, is a growth EIS fund manager that brings its long-standing experience in university-specific investment vehicles, currently managing funds for Cambridge, Oxford, Bristol and Imperial College London. Its track record of investing in over 180 companies across transformational sectors complements Northern Gritstone’s vision to leverage academic excellence for economic impact.

Lord Jim O’Neill, Chair of Northern Gritstone, said: “The North’s universities are home to some of the most exciting science and technology coming out of the UK. This collaboration with Parkwalk is an opportunity for investors to support what are potentially the next generation of global companies and to support regional growth to the benefit of the UK.”

The fund benefits from Northern Gritstone’s long-term agreements with its partner universities, providing preferred investor access to spinout deals. Parkwalk will take the lead on fund management, providing a route for high-net-worth individuals to invest in early-stage university commercialisation – a market often difficult to access outside institutional channels.

The post Northern Gritstone and Parkwalk team up for new EIS fund – will it deliver the UK’s first trillion-euro startup? appeared first on EU-Startups.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png?Expires=1838763821&Key-Pair-Id=K2ZIVPTIP2VGHC&Signature=IO0~CT3pU-TcxGc~yoZSmoQx23MZVuK-~4jSii~NKEblRmyO3el7NXPu~Rh1o23voASg7hlcHLw4kvQuDK1jssEhcjoNBBvEpZ~GGOAU6yosBhpHpeF179F~h7i6VxmsBNh9gtTutkoqY73O2YCFey~IAqSzKbBqETP1kP9cAg1916Z1YkJJs-5MliMrkZ5d7-mWGLbpHp2wGj2VlMph8XzYlL4~y1O7fB~JdIS~Rs4RMRs2x0WT1qUIpHAsf3GdwtOyAmKFSpIg8xCyNGZZ5h~13nXlmpd7uPvW8tBfttpG9pFTqcway-uch5WyfHOEfi7UlJCOWrr6fCYY5PMgSg__)