Over 300 economists urge Trump, GOP leaders to extend tax cuts before massive tax hike hits Americans

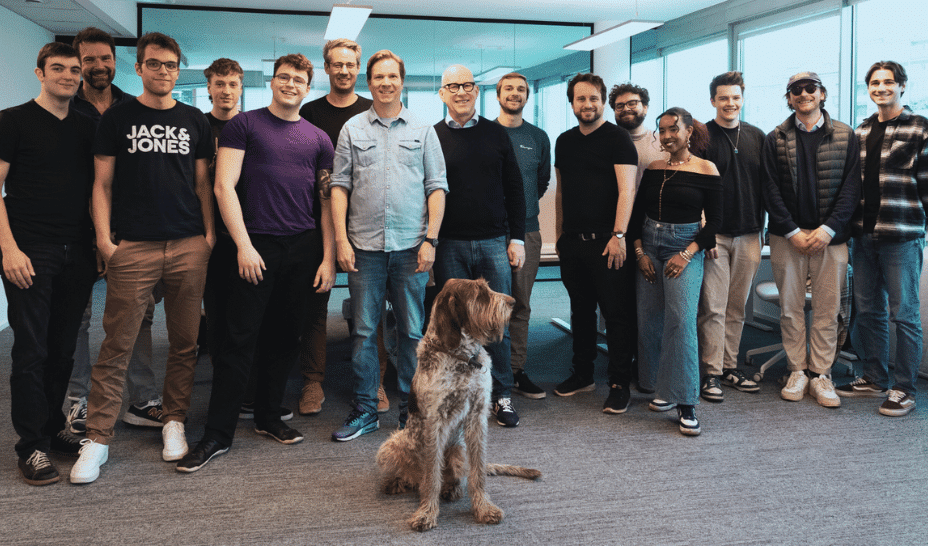

A group of more than 300 economists on Thursday sent a letter to President Donald Trump and Republican leaders in Congress urging the quick passage of the GOP tax package to prevent the expiration of the 2017 tax cuts and a $4 trillion tax hike they say would hurt the economy.

The letter was led by Stephen Moore, an economist and co-founder of Unleash Prosperity Now, and emphasized the extension of lower taxes on individuals and small businesses in the package. In addition, the simplification of the tax code, provisions that are due to expire at the end of the year, will effectively raise taxes on millions of Americans.

"We attracted over 300 economists, esteemed economists from some of the major universities, business leaders from around the country, and they all agreed that it would be good for the economy, good for business and good for American workers if we made the Trump tax cuts permanent," Moore told FOX Business in an interview.

"This was really devoted to, basically, the idea of making sure that the tax cuts that were passed in 2017 don't go away on Jan. 1st, because if Congress doesn't act, we're looking at the biggest tax increase ever," he explained.

TRUMP SPENDING BILL TO CUT TAXES BY $3.7T, ADD $2.4T TO DEFICIT, CBO SAYS

The letter said some critics of the bill have criticized the 2017 tax cuts as primarily benefiting the wealthiest Americans but actually contributed a larger share of tax revenue after the reforms.

"Despite all the talk about tax cuts for the top 1% and millionaires and billionaires, it turns out that the share of income taxes paid by millionaires and billionaires actually increased. In other words, their share of the federal income tax went from 42% to about 45% of the total," Moore said. "Most Americans aren't aware that the richest 1% pay almost half of the income tax, so we have a highly progressive system already."

"In percentage terms, the middle class got the biggest reduction in their tax payments, not the rich. So that's just a lie, and the left ignores the facts when they throw out these one-liners," he added.

PROGRESSIVE REP. CROCKETT SUGGESTS ELON MUSK IS ‘RIGHT’ TO LAMBASTE TRUMP-BACKED MEASURE: ‘TRASH’

Moore also noted the importance of the expiring tax cut provisions to small businesses, which he said play a key role in powering the U.S. economy.

"Small businesses – the men and women who run companies with anywhere from 10 to 100 employees – they're the backbone of the economy. They got a big tax cut on their business income … and that really helps small businesses prevail and expand their operations," he said.

ELON MUSK SLAMS GOP TAX BILL OVER DEFICIT IMPACT: 'DISGUSTING ABOMINATION'

Moore also pointed out that the Tax Cuts and Jobs Act of 2017 raised the standard deduction, which reduced the need for some taxpayers to itemize their deductions and "vastly simplified the tax code."

"Today in America, only 9%, or one out of 11 tax filers, has to itemize deductions. That made this tax system so much simpler. In other words, instead of having to keep shoe boxes full of receipts for your mortgage payments and your municipal bonds and your charitable giving, you just check one box and you get the deduction," he explained.

"If we don't extend the Trump tax cuts, everybody's going to have to go back to itemizing deductions, which is a big headache."

The letter doesn't address other elements of the package, such as Trump-backed proposals to end taxes on tips or overtime pay or the degree of spending cuts included.

Billionaire Elon Musk, former leader of the Department of Government Efficiency, and some conservative Republicans in Congress criticized the bill's projected deficits, which the Congressional Budget Office estimated would rise by $2.4 trillion over a decade.

"I think, on balance, I think this is a pretty good bill. It's not a great bill. It's a good bill that has to pass," Moore said. "I want to remind people that if it doesn't happen, we're talking about a $4 trillion tax increase next year, which would be devastating to American businesses and families. So it has to get done."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"The first step is making sure we have a healthy economy, and we're not going to have a healthy economy if we have a $4 trillion tax increase," Moore said.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png?Expires=1838763821&Key-Pair-Id=K2ZIVPTIP2VGHC&Signature=IO0~CT3pU-TcxGc~yoZSmoQx23MZVuK-~4jSii~NKEblRmyO3el7NXPu~Rh1o23voASg7hlcHLw4kvQuDK1jssEhcjoNBBvEpZ~GGOAU6yosBhpHpeF179F~h7i6VxmsBNh9gtTutkoqY73O2YCFey~IAqSzKbBqETP1kP9cAg1916Z1YkJJs-5MliMrkZ5d7-mWGLbpHp2wGj2VlMph8XzYlL4~y1O7fB~JdIS~Rs4RMRs2x0WT1qUIpHAsf3GdwtOyAmKFSpIg8xCyNGZZ5h~13nXlmpd7uPvW8tBfttpG9pFTqcway-uch5WyfHOEfi7UlJCOWrr6fCYY5PMgSg__)