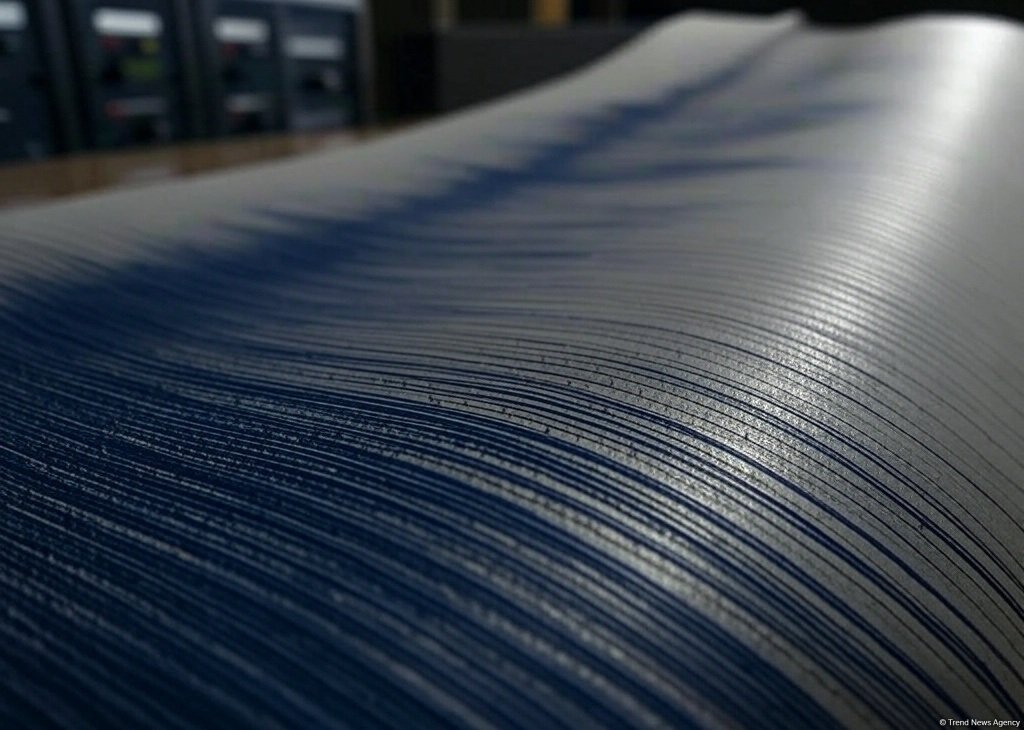

VC firm Tritemius launches Spain’s first regulated web3 VC fund with €21 million to invest in startups

Tritemius Fund FCRE I, a new VC fund with an initial close of €21 million and advised by Madrid-based Tritemius Capital, launched today with a focus on early-stage startups — from pre-Seed to pre-Series A — with average investments of €500k per company and reserved capital to support follow-on rounds.

The fund is managed by Abante, a leading financial advisory and asset management firm in Spain’s alternative investment industry, managing over €1.5 billion in private markets.

“We were born with the goal of filling a gap in blockchain investment and becoming a bridge between Europe, Latin America and the rest of the world. We firmly believe in the potential of web3 and the need for a fund that, in addition to financing, provides strategic insight and a strong network for entrepreneurs,” explains Luis Pastor, CEO and Co-founder of Tritemius Capital.

Tritemius Capital is a Spanish firm focused on investment and venture building in the web3 ecosystem. Its mission is to promote web3 entrepreneurship by leveraging trends that mass adoption of decentralised applications.

Members include Lluís Pedragosa Massó, with over 15 years of experience in VC across the U.S. and Israel in cybersecurity, web3, and FinTech; Pablo Romero, a crypto sector veteran and former member of BBVA’s Blockchain & Digital Assets team; and John Whelan, an independent advisor with early expertise in blockchain technology.

Tritemius operates within, what they refer to, as a “unique opportunity window“, fuelled by rising institutional and governmental adoption and clear regulatory frameworks.

Tritemius operates across three main areas:

- Venture Capital: Strategic investments in web3 and blockchain startups to accelerate the decentralised ecosystem.

- Venture Builder: Focused on launching startups within the Tritemius ecosystem, with an emphasis on DeepTech and blockchain. Combines proprietary project development with co-creation alongside large enterprises.

- Digital Assets: Focuses on market research, trend analysis, and valuation of projects through a quantitative-qualitative approach to identify value and generate insights for the group.

Tritemius Fund FCRE I is reportedly the only regulated VC fund in Spain fully focused on web3. It is authorised as a European Venture Capital Fund (EuVECA) under the CNMV, Spain’s financial market regulator.

Tritemius acts as the promoter and advisor to the fund, with a focus on identifying high-potential startups in growing markets.

The fund targets web3 entrepreneurs operating in key sectors such as decentralised finance (DeFi), blockchain infrastructure, cybersecurity, privacy, and tokenisation. “We are looking for projects that not only show great growth potential but also offer real, disruptive solutions in decentralisation and cybersecurity,” adds Pastor.

Startup selection is based on two key aspects: the founding team and the size and viability of the market opportunity, including competition and business model. “One of the decisive factors in our investment decisions is the quality of the founding team. In this sector, having highly skilled talent and a clear vision of the impact of their technology is essential,” Pastor highlights.

The advisory team sees a strategic opportunity in the sector, driven by greater institutional and governmental adoption of blockchain technology, clearer regulatory frameworks, increased ecosystem maturity and the growing adoption of decentralised applications.

Beyond funding, Tritemius Fund FCRE I offers strategic support to startups through mentoring, industry and regulatory networking, and international expansion strategies. “It’s not just about capital, but about walking alongside Founders to ensure they have access to the resources and connections they need to scale.”

The firm points to key trends in web3 and blockchain such as improved usability and scalability through innovations like intents, account abstraction and zero-knowledge proofs (ZKP), as well as the development of DeFi, DePIN, and decentralised social networks. They also highlight opportunities in cybersecurity platforms that protect decentralised systems and in bridging traditional finance with the web3 ecosystem.

Tritemius Capital aims to become the leading VC firm for web3 and crypto in Europe. The firm will seek out pioneering startups driving mass blockchain adoption and explore new markets and verticals, including deeptech. “We want startups to feel that we speak their language. That’s essential in such a specialized sector, while also having a foot in regulation, institutions and investor access.”

Tritemius has already begun evaluating its first deals and plans to invest immediately in four high-potential startups. These include a Spanish web3 cybersecurity company, a firm operating in Spain and Latin America focused on tokenising guarantees for microloans, and a U.S.-Israel startup offering integrated digital asset operations solutions.

The post VC firm Tritemius launches Spain’s first regulated web3 VC fund with €21 million to invest in startups appeared first on EU-Startups.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png?Expires=1838763821&Key-Pair-Id=K2ZIVPTIP2VGHC&Signature=IO0~CT3pU-TcxGc~yoZSmoQx23MZVuK-~4jSii~NKEblRmyO3el7NXPu~Rh1o23voASg7hlcHLw4kvQuDK1jssEhcjoNBBvEpZ~GGOAU6yosBhpHpeF179F~h7i6VxmsBNh9gtTutkoqY73O2YCFey~IAqSzKbBqETP1kP9cAg1916Z1YkJJs-5MliMrkZ5d7-mWGLbpHp2wGj2VlMph8XzYlL4~y1O7fB~JdIS~Rs4RMRs2x0WT1qUIpHAsf3GdwtOyAmKFSpIg8xCyNGZZ5h~13nXlmpd7uPvW8tBfttpG9pFTqcway-uch5WyfHOEfi7UlJCOWrr6fCYY5PMgSg__)