What do you need to remember when setting up a startup in Poland? (Sponsored)

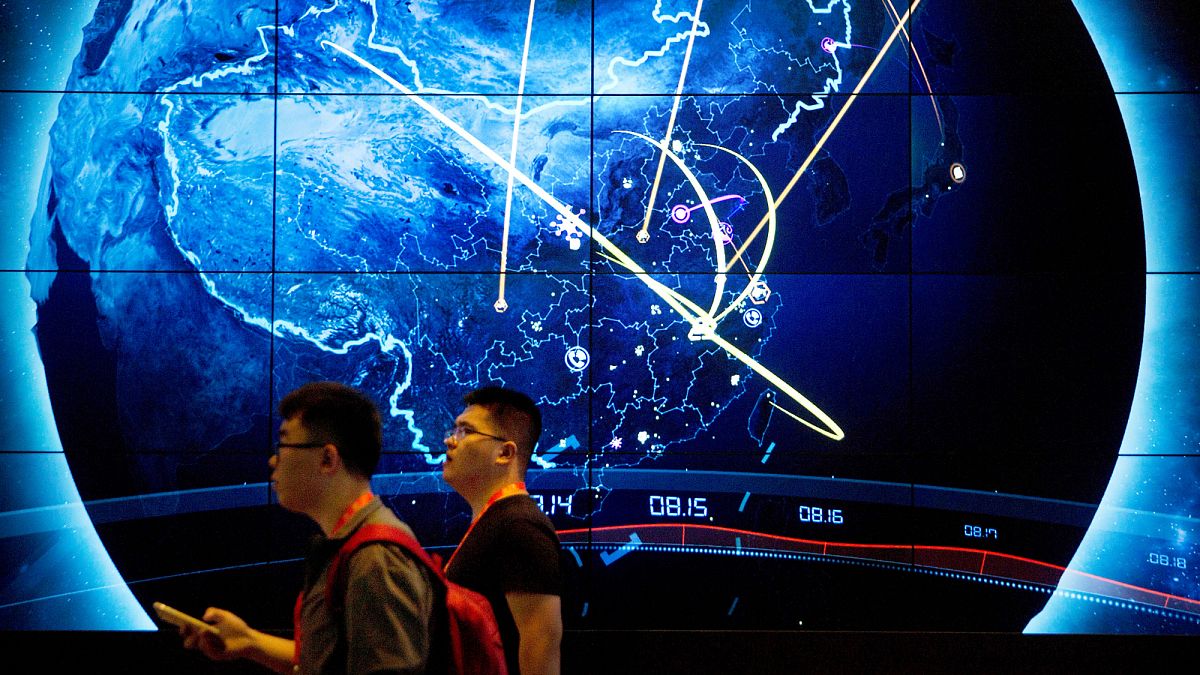

Poland is an attractive location for foreigners interested in starting a business. With its dynamic economy, qualified staff, and still competitive operating costs of running a business, Poland offers favourable conditions for new commercial undertakings, including startups.

Are you thinking of setting up a startup in Poland? You should know the following information about our country before making a decision:

Despite the recent turmoil on international markets, Poland remains a stable country – with growing GDP and real purchasing power – a fact which has been appreciated by entrepreneurs. According to the official data of the World Bank, Poland’s Gross Domestic Product (GDP) was USD 809.2 billion in 2023, with 3.23% growth year-on-year at the end of 2024. This is a good sign for entrepreneurs and investors, which indicates economic development. Forecasts for the future are also optimistic, suggesting further progress. What may also be relevant for foreigners is the fact that Poland, as one of the biggest European economies, has experienced a strong growth in comparison with other EU countries, and this translates to the higher purchasing power of its residents.

It is also worth noting that the IT industry has significantly developed in Poland in recent years, which means that more qualified specialists with marketable skills are available. This might be Poland’s strong asset, especially for startups, which are somewhat “by definition” associated with new technologies and innovation.

It seems, therefore, that running a business in Poland is a good idea. And while, objectively speaking, such a decision brings a lot of benefits, one has to take into account the so-called “challenges”, i.e. legal and tax aspects, which often create difficulties for entrepreneurs-visionaries. In fact, even the best and most innovative business idea may fail if bookkeeping is not in compliance with applicable law and regulations. And even though a lot of administrative matters may be handled online from any place in the world, an insurmountable obstacle for foreigners may be the language barrier (as most official procedures are still conducted only in Polish). In spite of a relatively high level of digitisation of public services, it is worth considering seeking the support of an expert who speaks Polish and has extensive knowledge of applicable law, since – it must be clearly emphasised – Polish regulations are complex and often difficult to understand by persons from other jurisdictions.

Can the said challenges scare away potential entrepreneurs? Not necessarily; people can deal with anything, so it is a good idea to learn more about the requirements and make the final decision with that knowledge.

Why is a limited liability company the best legal form for a startup?

Before undertaking formal activities, we should think about what kind of business we would like to conduct, and in which industry and on what scale we would like to operate. The answers to the above questions will help us to determine further activities in the process of setting up the company, and will be useful, for example, in choosing the legal form of the newly established business. We can share our experience at this point: the best form of business activity for a startup will be a limited liability company. Below is a list of advantages of a Polish limited liability company:

- Limited liability of owners (shareholders) – A limited liability company is an incorporated entity with legal personality. As such, shareholders are not liable for the company’s debts with their assets. Such a company is a separate entity, whose assets are detached from those of its owners.

- It can be established for any lawful purpose – Unlike partnerships, companies need not be business enterprises, i.e. companies can engage in not-for-profit activities (e.g. philanthropy).

- Costs of incorporating and running a limited liability company are relatively low – In the case of limited liability companies, the minimum amount of share capital is as low as PLN 5,000 (as compared to joint-stock companies, where the minimum amount of share capital is PLN 100,000); in addition, in view of the circumstances described below, the day-to-day operations of limited liability companies do not generate substantial costs.

- Possibility to set up a company online – Limited liability companies (and simple joint-stock companies, registered partnerships, and limited partnerships) may be set up in the S24 portal, in which a ready template of the articles of association is available to use and fast track (priority) registration with reduced court fees is enabled. On the other hand, due to the technical limitations associated with setting up a company online, this solution is addressed mostly to entrepreneurs who wish to launch operations as quickly as possible, with the possibility of adjusting the operating procedures of the company to their specific needs only at a later date.

- Little formalism – in contrast with the articles of association of joint-stock companies, it is possible to include additional elements not listed in the statute (the Code of Commercial Companies – the Code) in the articles of association of limited liability companies, unless such elements are disallowed in the Code.

Furthermore, in the case of limited liability companies:

- It is not necessary to take minutes of all general meetings in the presence of a notary. The presence of a notary is only required in the cases laid down in the Code, e.g. when amending the articles of association. On the other hand, it is possible to form a management board as well as approve financial statements or adopt resolutions on shareholder distribution on the basis of minutes taken in simple written form.

- As a general rule, it is not necessary to form a supervisory board.

- In contrast with joint-stock companies, there is no requirement to create an electronic register of shareholders (which entails additional costs and organisational activities), with a register of shares kept in simple written form being sufficient for limited liability companies.

What are the next steps after choosing a limited liability company as the form of your business?

- Registering the business activity with the registry court. You can do it online by yourself, but we recommend consulting with a person who speaks Polish and knows the law well. The whole process takes place electronically, in Polish. The documents which must be attached to the application must be translated (and also authenticated, typically by an apostille).

- Registering with the Central Register of Ultimate Beneficial Owners (CRBR). It must be made within 14 days from registering with the registry court. Registration is only possible online, in Polish. Failure to comply with this obligation is subject to a high fine.

- Obtaining a REGON number, which is an identification number in the National Official Business Register. It is assigned free of charge and automatically after registering the company with the registry court and is used for the identification of the entity in the registers and databases for monitoring business activities. It is updated on an ongoing basis, therefore being a reliable source of information about the company.

- Obtaining a NIP number, which is a tax identification number. As the name suggests, it is used for the identification of the company in relations with the tax authorities. Similarly to REGON, the NIP number is also assigned to the company free of charge and automatically after registering the company with the registry court.

- Opening a bank account. Holding a corporate bank account is virtually indispensable for carrying on business effectively. However, it must be pointed out that before opening an account, the company has to undergo thorough screening by the bank, which is a requirement arising from the stringent regulations concerning anti-money laundering and countering the financing of terrorism. The purpose of this process is to verify the ultimate beneficial owner of the company, i.e. the natural person exercising direct or indirect control over the company. To this end, in the case of companies belonging to multinational holdings, it is necessary to collect a number of corporate documents, such as the articles of association, excerpts from foreign commercial registers, etc. and have them authenticated and translated. Unfortunately, this frequently makes opening a bank account a time-consuming and costly process.

- Obtaining a qualified electronic signature from a Polish provider. Polish law states that every company is obliged to file annual financial statements. Signatures from foreign providers – even those qualified – are often not recognised by the system for submitting filings. Therefore, a signature issued by a Polish provider should be obtained adequately beforehand by taxpayers who wish to file documents themselves. The same is true for the PESEL number, which is a personal identification number assigned automatically to Polish citizens. It is not obligatory for foreigners, but it is very helpful if you wish to handle official matters in our country by yourself, also online.

- Obtaining additional permits and licences (if required for your products or services). Depending on the type of your business – and often on the industry as well – it might be necessary to obtain additional licences or permits. What kind of licences and permits? It is best to consult this issue with a professional knowing the regulations.

As you can see, setting up a startup may pose a challenge, but it is much easier with the support of an experienced specialist. Nevertheless, it is just the beginning of the road. What should the next step be? To ensure proper bookkeeping and tax filings.

What challenges may foreign entrepreneurs face in Poland?

Bookkeeping in Poland requires compliance with a number of regulations and standards. It is often necessary to have expert knowledge in the areas of accounting, taxation, and law. Therefore, it is advisable to invest in the right tools and cooperate with experienced specialists to avoid unnecessary legal and financial setbacks. Understanding local accounting and tax requirements is crucial for carrying on business in Poland with success. The section below contains relevant information which might be helpful at the start.

- Polish Accounting Standards – In accordance with the Polish Accounting Act, account books, with few exceptions, must be kept in line with the Polish GAAP.

- Accounting system – Limited liability companies are obliged to keep their books under the so-called full accounting system, regardless of the scale of operations in Poland.

- Language and currency – Account books of Polish entities must be kept in the Polish language and currency (PLN). In practice, this means that all transaction descriptions, account names, and reports generated by accounting software must be made in Polish.

- Opening of accounts – In accordance with the Accounting Act (Article 12), accounts must be opened as at the start date of the operations, which is the day of the first property-related or financial event. The opening of accounts must be effected not later than within 15 days from this event. The first accounting transaction is typically the contribution of capital, without which company registration is not possible.

- Financial statements – Within three months from the end of each fiscal year, the company is obliged to prepare its financial statements in electronic form in line with the proper file structure made available by the Ministry of Finance.

- Electronic signatures – Financial statements must be signed electronically by board members with a qualified electronic signature obtained from a Polish provider.

- Approval and filing of financial statements – Financial statements must be approved within six months from the end of the fiscal year and subsequently filed electronically with the registry court within 15 days from their approval.

- Mandatory audit – Audit of financial statements becomes mandatory after exceeding the thresholds specified in the Accounting Act. Entities operating in certain industries are subject to mandatory audit regardless of their size.

- Corporate Income Tax – Limited liability companies pay corporate income tax (CIT) at the rate of 9% or 19% depending on their revenue.

- VAT – A newly established entity should consider registering for VAT. The standard rate in Poland is 23%.

- Withholding tax – The management board should analyse (preferably in cooperation with tax advisors) whether transactions concluded with foreign contractors are subject to WHT.

- Statistical reporting – The Statistics Poland (Polish: Główny Urząd Statystyczny) may oblige a company to draw up statistical reports that must be prepared and sent to the Statistics Poland via a dedicated reporting portal within the time frame specified by the authority.

- Reporting to the National Bank of Poland – Business entities trading internationally may be obliged to report to the National Bank of Poland – businesses should be up to date with the relevant limits and obligations.

- Choosing the right software – Accounting software should not only meet the conditions specified in the Accounting Act but also ensure that files can be generated in line with the JPK (Polish SAF-T) structure, as required by the National Revenue Administration.

- Employer obligations – if, on top of that, the company is to take on employees, it should consider some additional obligations, including:

- registering the business entity as an employer,

- concluding a contract with a selected financial institution that will manage the funds aggregated under the PPK saving scheme (Employee Capital Plans),

- ensuring employee medical check-ups,

- providing Occupational Health and Safety training.

Why is it advisable to start your business with an experienced partner?

An experienced business partner – such as RSM Poland – has access to infrastructure enabling the smooth running of your company. This gives you peace of mind and makes you feel certain that business operations are in compliance with the law. Learn more here.

It has long been known that delegating the responsibility for certain areas to a specialist with considerable knowledge in their field is cheaper than handling the situation on one’s own. Polish law does not make it easy for international investors to run a business, therefore, it is worth handing over bookkeeping and taxation matters to professionals and concentrate on expanding those components of the company which build its competitive advantage.

The post What do you need to remember when setting up a startup in Poland? (Sponsored) appeared first on EU-Startups.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png?Expires=1838763821&Key-Pair-Id=K2ZIVPTIP2VGHC&Signature=IO0~CT3pU-TcxGc~yoZSmoQx23MZVuK-~4jSii~NKEblRmyO3el7NXPu~Rh1o23voASg7hlcHLw4kvQuDK1jssEhcjoNBBvEpZ~GGOAU6yosBhpHpeF179F~h7i6VxmsBNh9gtTutkoqY73O2YCFey~IAqSzKbBqETP1kP9cAg1916Z1YkJJs-5MliMrkZ5d7-mWGLbpHp2wGj2VlMph8XzYlL4~y1O7fB~JdIS~Rs4RMRs2x0WT1qUIpHAsf3GdwtOyAmKFSpIg8xCyNGZZ5h~13nXlmpd7uPvW8tBfttpG9pFTqcway-uch5WyfHOEfi7UlJCOWrr6fCYY5PMgSg__)