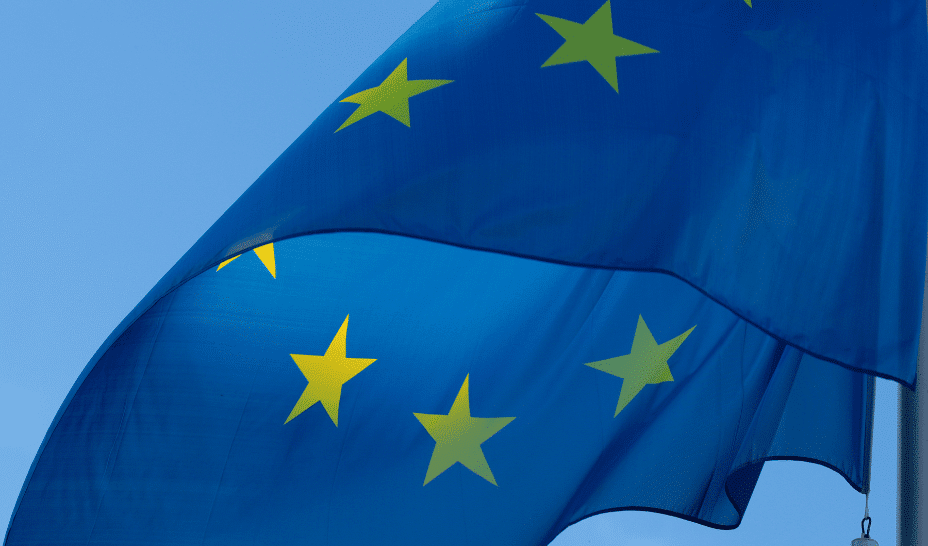

Why Europe needs to go its own way to build a greater tech ecosystem?

Europe’s tech ecosystem is at a crossroads. While its challenges have been widely discussed, ranging from fragmented markets to exit difficulties, there is a growing sense that the tide may finally be turning. The recent launch of 20VC’s Project Europe to support early-stage founders and the viral petition by EU-Inc calling for a unified pan-European startup entity are not isolated events. They reflect deep-seated frustrations—but also renewed determination to change course.

The truth is that European policymakers are starting to listen. Last year’s Draghi Report has galvanised positive action, and February’s Paris AI Action Summit exhibited how policymakers recognise that entrepreneurs will make or break Europe’s bid for relevance in the AI race.

This is more than a case of warm words. There are plenty of reasons to be optimistic about the prospects of European tech.

Policy moving in the right direction

Talent and capital availability are key factors for tech entrepreneurs choosing where to launch and scale their companies. Conditions in Europe for both are moving in the right direction.

Forward-thinking immigration policies, such as the UK’s Global Talent visa and France’s Talent Passport, make it easier for European founders to hire top talent from across the globe—and, naturally, it’s easier for that talent to relocate to Europe. The mobilisation of sovereign wealth through initiatives like France’s BPIfrance and Italy’s CDP Ventures is also boosting the competitiveness of Europe’s capital markets.

The impact and influence of such policies can usher in better days for European tech. But the direction of progress matters. Those in Europe who look at the US’s remarkable tech success story with envy should not fall into the trap of drawing the wrong conclusions. Europe will never become the US, and its success will not come by following the same playbook.

Embracing our uniqueness

In what makes Europe different, there is plenty for regional entrepreneurs to seize on. The heterogeneity of language across Europe’s nations creates fantastic opportunities for Europe to become home to the best translation services and local language generative AI startups in the world. Similarly, the heterogeneity of currencies has driven Europe to become home to leading FX products and fintechs, and there is every reason to believe that trend will continue.

The unique dynamics of Europe’s national infrastructure can also be leveraged as strengths. The fact that nuclear power is France’s largest source of electricity, for example, is a major draw for startups seeking stable and green energy for data centres and AI compute.

These are just a few practical examples of how Europe can triple down on its strengths rather than trying to replicate the startup playbooks of other regions. I believe that is the best way for European tech to flourish and seize its opportunities.

Much of this opportunity lies within Europe itself—in nations with less mature tech ecosystems. Regional founders who understand their home markets inside and out can drive tech disruption, navigate local regulations, and benefit from public funding in ways that market entrants from other nations cannot.

Focusing on the exit question

To realise its potential, Europe’s exit problem must be addressed. The long-discussed Capital Markets Union (CMU)—a single capital market across Europe—would be a game-changer, easing cross-border investment and funding.

The benefits of a CMU would be transformative for the European ecosystem. Increased cash returns for European tech investors, for example, would likely lead to greater reinvestment into new startups, catalysing further growth.

The disadvantages of IPOing in the US would also come under greater scrutiny. American funds, asset managers, and retail investors are less familiar with European companies that pivot to the US for an IPO (especially if they have limited US presence), and there are risks to being a small fish in a big pond. IPOing in the US also places a heavier reporting burden on founders or CEOs, requiring four financial disclosures per year compared to two in Europe.

These are clear downsides to exiting via an IPO in the US. But to highlight them more strongly, founders must be convinced that Europe offers a viable alternative.

A brighter future

Europe has the talent and ambition to become one of the world’s major tech ecosystems. Making it happen requires more of our brightest minds to build and scale their tech businesses at home. Improving exit conditions would go a long way toward making this a reality, and should be a major focus for policymakers.

The post Why Europe needs to go its own way to build a greater tech ecosystem? appeared first on EU-Startups.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png?Expires=1838763821&Key-Pair-Id=K2ZIVPTIP2VGHC&Signature=IO0~CT3pU-TcxGc~yoZSmoQx23MZVuK-~4jSii~NKEblRmyO3el7NXPu~Rh1o23voASg7hlcHLw4kvQuDK1jssEhcjoNBBvEpZ~GGOAU6yosBhpHpeF179F~h7i6VxmsBNh9gtTutkoqY73O2YCFey~IAqSzKbBqETP1kP9cAg1916Z1YkJJs-5MliMrkZ5d7-mWGLbpHp2wGj2VlMph8XzYlL4~y1O7fB~JdIS~Rs4RMRs2x0WT1qUIpHAsf3GdwtOyAmKFSpIg8xCyNGZZ5h~13nXlmpd7uPvW8tBfttpG9pFTqcway-uch5WyfHOEfi7UlJCOWrr6fCYY5PMgSg__)